Part Three: Financing that Continually Optimises Residents’ Savings

In our previous blog on ‘Sustainable Financing’, we found that software-led insurance is key to unlocking at scale social housing retrofits. It does this by supporting the provision of long-term, flexible private finance and guaranteeing day-one resident savings.

But what does this look like in practice? And how can resident impact be maximised post-installation? The answer lies in a billing platform plus metering and monitoring.

A Billing Platform that Maximises Residents’ Benefits

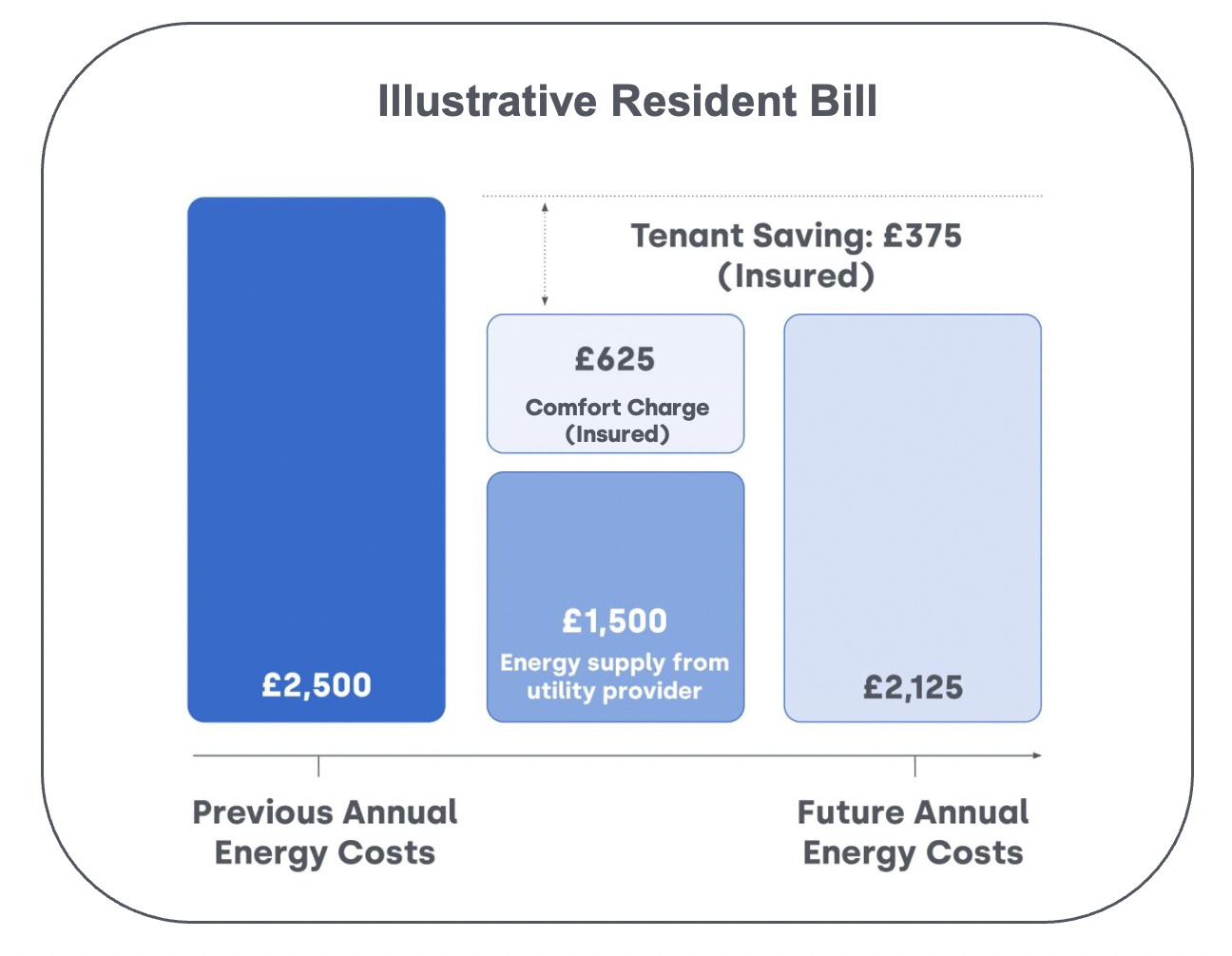

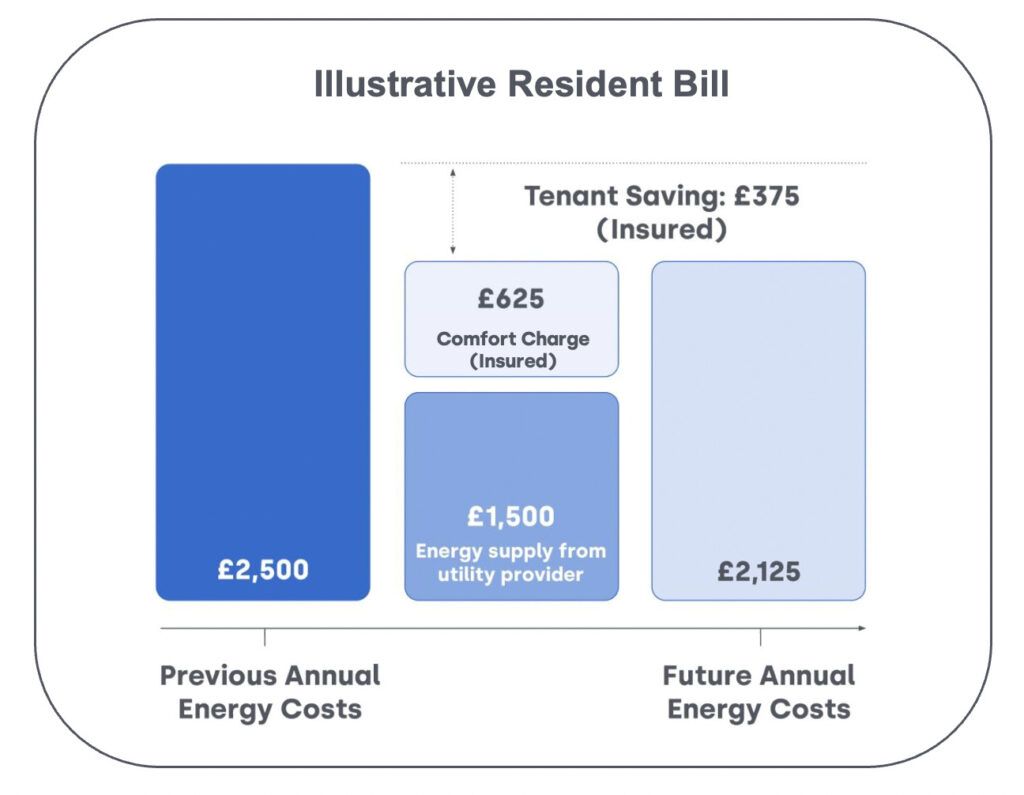

For projects to be financed under a shared savings model – where some energy bill savings are used to pay project costs and some are left with residents – funders need a recovery mechanism. In other words, a billing platform. This platform needs to combine residents’ regulated energy charges for residual grid exposure with a comfort charge to service the finance. A comfort charge is made up of a percentage of the savings and typically includes fixed and variable elements based on metered energy usage, similar to a standard utility bill.

Full transparency over this is crucial for residents. They need to see a detailed breakdown of what they are paying for, how much they are saving overall as a result of retrofits, and how they can manage their consumption to maintain or increase those savings. And the savings can be substantial – with projects reducing their bills by hundreds of pounds a year.

When managed effectively, a billing platform can be so much more than a repayment mechanism for funders. It can enable residents to automatically switch to the best tariffs, share in community revenue from solar and battery optimisation (i.e., Virtual Power Plants and Demand Side Response), and receive granular insights into their home’s energy costs. This platform can even be linked to home metering and monitoring systems to showcase the cheapest times to use energy.

Metering and Monitoring Supports Greater Resident Savings

Metering and monitoring is a key part of enhancing residents’ savings and comfort. It allows for automatic home optimisation and immediate fault detection and repair, ensuring problems do not persist. Even more than that, it paves the way for a data-led pathway for the rest of residents’ net zero journey. Energy usage data shows what measures will work in the future – building robust business cases for new interventions that have residents’ comfort at their heart.

This same metering also facilitates real-time, detailed performance and impact reporting for the insurer and funder – demystifying and further derisking projects. For landlords, this results in a lower cost of finance for future works; for residents, it generates additional bill savings; for funders, it gives them a highly attractive, differentiated, and verified ESG product, in turn, supporting even further reductions in the cost of finance for landlords – and so the virtuous cycle of impact continues. And this will only increase as retrofits continue to scale.

How Tallarna and Sero Are Helping Social Housing Landlords and Residents

Tallarna, on behalf of their Social Housing Provider customers, has used the methodology discussed in these three blogs to engage with a panel of highly experienced funders. These funding partners are able to cover a significant majority of the costs for social housing retrofits against guaranteed savings – a huge enabler of at scale projects.

While Tallarna delivers this first bit of the funding solution – working with insurers and financiers – Sero delivers the second through their project optimisation expertise, billing platform, and resident engagement experience. Sero’s billing platform oversees residents’ guaranteed day-one savings, recovers and passes on some of these savings to the finance provider, and pays the residual grid energy cost to the utility. In collaboration, Tallarna and Sero have structured retrofits that leave up to 50% of the bill savings with residents.

Tallarna and Sero have created an end-to-end retrofit model that benefits all project stakeholders. SHPs get compliant homes provided ‘as-a-Service’ with a replicable, multi-year, off balance sheet funding line; funders get guaranteed ESG income; and residents get guaranteed day one bill savings and a more comfortable home. This package offers SHPs a new level of control over their projects and gives them a standardised route-to-market to raise private finance. By enabling new forms of prosperity for people and the planet, meaningful decarbonisation is beginning to happen at scale.

If you have any questions, please email press@tallarna.com.

Authors

Tim Meanock, CEO, Tallarna

Tim Meanock is the Chief Executive Office of Tallarna. He co-founded the company in 2017 with a focus on addressing the funding gap in building decarbonisation. Tim was previously a senior executive in a high growth technology company in the video and analytics space, and prior to that spent nine years in mid-market private equity with a focus on the real estate sector.

James Williams, CEO, Sero

James is a founder and the CEO of Sero. Sero is a BCorp, that works across homes, energy, and finance, combining net zero expertise with data driven technology, to bring affordable and sustainable solutions, at scale to housing providers and residents.