Part One: The Retrofit Financing Landscape for Landlords and Funders

In the first of a three-part blog series on ‘Sustainable Financing’, Tallarna and Sero explore the financial landscape facing Social Housing Providers (SHPs) and where private finance needs to slot in. Subsequent blogs will look at how to deliver a shared savings model and what financing success stories we can draw from.

The Need for Large-scale Private Finance to Support Retrofits

By 2050, the UK’s 5 million social homes are legally required to be zero carbon – with the requisite work expected to total £104 billion. But with grant funding only covering around £10 billion of the costs, SHPs need private finance to support.

Currently, a perception of inadequate financing solutions is holding back action. According to the National Housing Federation, 74% of their members see funding as their biggest barrier to retrofits. Yet this is at odds with the fact that over $4 trillion has been invested in green projects in the past decade globally – much of that in retrofits.

For many SHPs though, it’s not the amount of finance which is the issue. It’s the fact most is priced too high and does not adequately transfer the associated risks. So, what is causing this disconnect?

Funders’ Perspective: What’s Holding Back a Lower Cost of Capital and a Higher Loan-to-Cost?

The global macroeconomic outlook over the past few years has been precarious for the UK financial services sector. Covid-19, the energy crisis, and the 2022 mini-budget resulted in shockwaves that sent inflation soaring. The Bank of England SONIA interest rate benchmark stood at 5.2% as of September 2023. In December 2021, it was 0.05%.

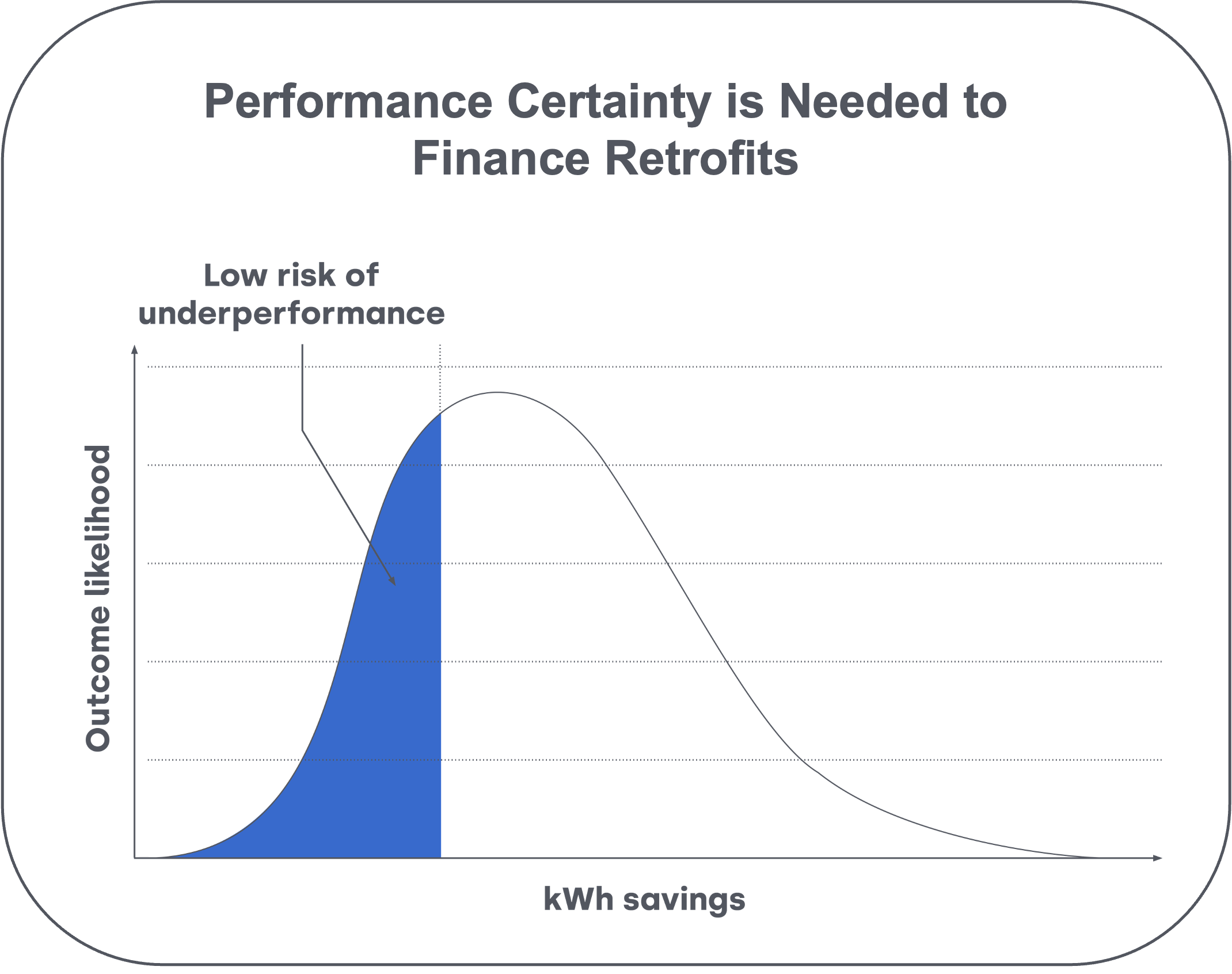

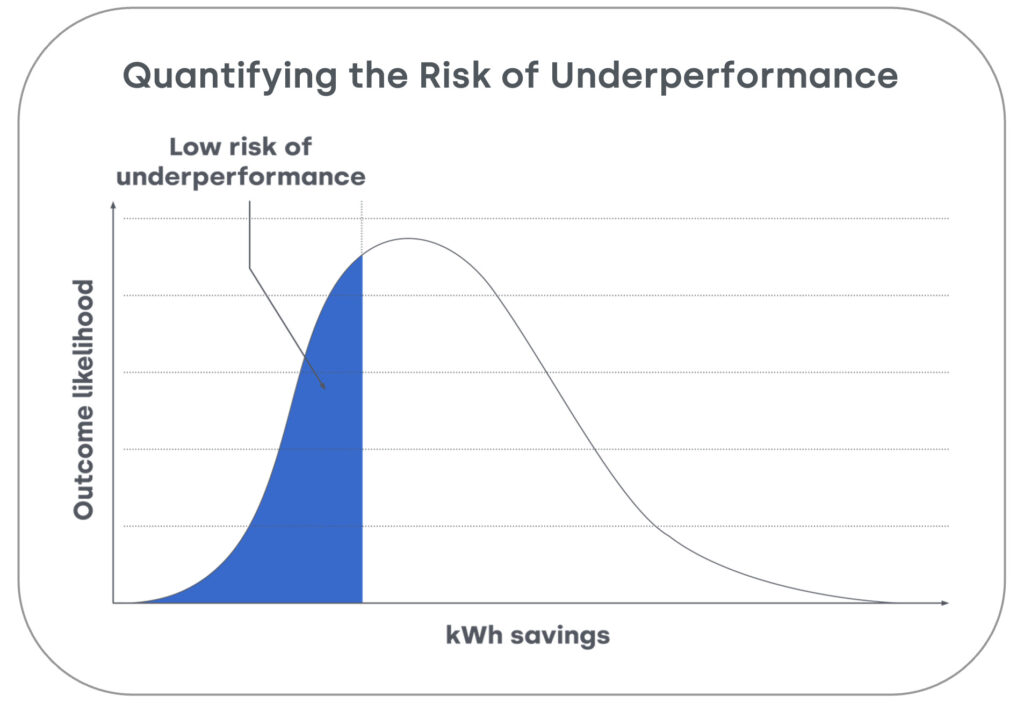

Such volatility has destabilised the market and lowered investors’ risk appetite. This is bad news for SHPs. While property financing is an established practice, retrofit financing is not. Funders lack decades worth of data from which to estimate a revenue floor – in other words, a guaranteed level of income. And without this, it is difficult for funders to understand and get behind works.

The Importance of Data for Funders

Lack of historical data on homes’ energy usage translates to an uncertain risk profile. This is especially true for projects financed under a shared savings model – where some energy bill savings are used to pay project costs and some are left with residents. Essentially, lack of data makes it more difficult for funders to quantify whether projects’ predicted energy savings will match the delivered reality. And should a disconnect occur between these numbers, there are huge financial, reputational, environmental, and social ramifications.

First and foremost, social housing residents’ energy bills could increase. And until the underperforming technology asset is identified and fixed, this savings’ deficit will continue, hurting residents financially and increasing carbon emissions. Consequently, the main reasons for doing projects – mitigating fuel poverty and cutting emissions – could be nullified.

Where funders do support a project with inadequate data, they price in the above risk – increasing the cost of capital, lowering the loan-to-cost, and shortening the repayment term. Alternatively, they seek additional security from the SHP which is not palatable. For many SHPs, this makes most finance on offer unviable.

How Financial Structuring Compounds the Challenge

Part of the challenge for both funders and SHPs is the scale and structure of private finance required. SHPs need to source over £90 billion to get their stock to net zero – an eye-watering number – from either private finance or their own budgets. While some do have money set aside for building upgrades, it usually falls far short of the mark – particularly with recent macroeconomic events requiring the release of emergency funds to support residents with the cost of living crisis.

In terms of finance structure, SHPs may need to need to achieve “off balance sheet” accounting treatment. Essentially, this means ensuring project finance is not classified as a liability according to accounting practices and does not cause friction with the secured finance already raised against landlord’s properties.

In today’s climate, off balance sheet accounting treatment is particularly important as many landlords’ financial covenants and business plan metrics are being stressed by recent headwinds; notably, rent caps, operating and capital cost inflation, fire and building safety remediation requirements, and the need for damp & mould eradication, to name a few. These headwinds are already starting to adversely impact landlords’ interest and debt cover ratios. The urgent necessity of decarbonisation and its associated capital expenditure adds yet another layer of pressure on to landlords’ covenants.

This leaves SHPs with potentially limited headroom to finance decarbonisation works from their own internal resources or on their balance sheet. To do so could stress their interest and debt cover ratios to the point where (potentially) a SHP would be in breach of covenants under their financing agreements.

Key Considerations for Project Finance

As a result of the above, both investors and SHPs need to consider an alternative approach to financing decarbonisation works. One where project finance is raised by a third party which is viewed as being off balance sheet. While third-party project finance is not new, it does entail careful structuring. Appropriate risk allocation is fundamental to this strategy, since investor security is primarily the generated cash flows (i.e., the energy savings).

The key questions that have to be addressed by this approach are how to ensure project finance investors’ risks are adequately managed and mitigated while ensuring that those same risks are not transferred to and borne by SHPs or their residents (which would defeat the objective of securing off balance sheet treatment). The need to solve this issue is acute given that SHPs have over a million homes which will become non-compliant in 2030. And should this happen, millions of residents could fall into precarious housing situations as their homes become legally unlettable. At the same time, outstanding loans on these non-compliant and now unlettable properties will have their rates increased as they will be deemed substandard – especially if these loans are linked to Key Performance Indicators (KPIs) such as EPC rating. Increased interest rates and the inability to refinance is something SHPs can little afford and will further harm residents.

Where Private Finance Needs to Support

As we’ve seen above, there are two core requirements to get finance in the right place and at the right price point for SHPs:

- A risk backstop for project cash flows to give funders sufficient confidence in the performance of the project.

- Off balance sheet treatment so available finance works within SHPs existing borrowing commitments.

In our next blog in this series, we’ll be exploring how we can overcome the challenges facing funders and landlords. Namely, how to introduce large-scale, flexible finance while ensuring that residents benefit from day-one bill savings!

For more information on anything raised in this blog, please email press@tallarna.com.

Authors

Tim Meanock, CEO, Tallarna

Tim Meanock is the Chief Executive Office of Tallarna. He co-founded the company in 2017 with a focus on addressing the funding gap in building decarbonisation. Tim was previously a senior executive in a high growth technology company in the video and analytics space, and prior to that spent nine years in mid-market private equity with a focus on the real estate sector.

James Williams, CEO, Sero

James is a founder and the CEO of Sero. Sero is a BCorp, that works across homes, energy, and finance, combining net zero expertise with data driven technology, to bring affordable and sustainable solutions, at scale to housing providers and residents.