Solving the Social Housing Funding Deficit

Over the next 30 years, UK social housing providers must retrofit over five million homes. Not only does this involve building work of considerable magnitude, it comes with an eye-watering price tag of £104 billion. Securing efficient, private finance is going to be increasingly vital to get projects to execution.

How large is the deficit?

While the government has mandated building decarbonisation across all social homes, their financial contribution amounts to less than 10% of the total cost. And getting hold of private funding to plug this gap is easier said than done. Current third-party financing options require security against the assets (social homes themselves), as opposed to the cashflows generated from retrofits (savings on the bill). And available security does not stretch far enough.

As an interim measure, landlords have been trying to access the limited grants available to them and reconfigure budgets to fund projects. But the reality is that no amount of restructuring will solve the £96 million retrofit deficit. New financial mechanisms must be explored. And as fuel poverty rises and the climate crisis deepens, finding a financeable way forward is needed to secure a liveable, affordable future for all.

The reasons for investor reluctance

Insufficient private finance and unattractive terms boil down to investors’ lack of confidence in retrofit success. Historical disconnect between predicted outcomes and delivered results – usually for the worse – has led funders to take a cautious approach. Retrofits have become seen as financial liabilities. Yet, when done well, projects result in warmer homes that lead to happier residents and reduced levels of fuel poverty. For landlords, they defend net present value and increase net operating income – making retrofits financial assets

So, where does the disparity lie? And how can it be overcome? The answer can be found in an ecosystem approach. By connecting stakeholders across the retrofit value chain, landlords are empowered to align projects that work from engineering, resident, insurance, and financial perspectives. And the first place to start is by establishing a portfolio-wide view.

How data helps you look before you leap

Data underpins all parts of the retrofit process – from understanding buildings’ baseline energy consumption and recommending low-carbon measures, to identifying which properties to prioritise and getting contractors onsite. And the data points used at each stage of project development must align and build on one another to attract financing.

But often, housing providers lack recent, complete, and validated information on their stock’s condition. As a result, they struggle to know the best and most fundable route forward.

This is where AI comes in. By combining providers’ existing stock data with archetypal building insights, AI can fill in data gaps to provide initial project decision-support. So, not only does AI enhance providers’ understanding of their buildings but it pinpoints where more data is needed. Targeted surveys can then be undertaken to validate the AI’s assumptions and confirm which homes need to be addressed first.

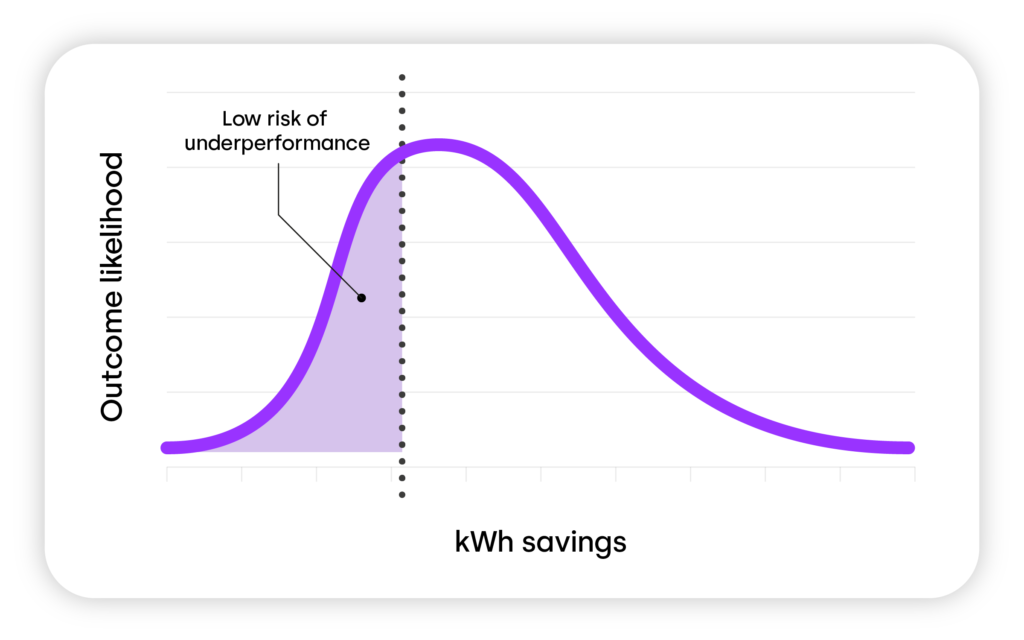

Once stock data has been analysed and digital building twins created, AI-driven retrofit analysis can take place. Adaptive in its understanding and dynamic in its scope, AI can stochastically model retrofit scenarios to account for building energy uncertainties.

So, instead of assuming the ideal retrofit scenario, AI considers all possible retrofit measures to determine what combination of works provides the best outcome, what outputs are the most likely, and what is fundable. These models use an engineering accredited approach to provide project output transparency. This means that early on, landlords can see indicative retrofit cost projections, energy bill savings, and carbon emission reductions as maps to a likely reality.

Mind the uncertainty gap

Having highly relevant, predicted project outcomes is key to the decision-making process. Social housing providers need to know the ratio of cost-to-savings, what cash flows will look like post-retrofit, and how to structure projects across an entire portfolio to make the right decisions for residents, the planet, and their balance sheet.

Risk quantification is invaluable in understanding the likelihood and magnitude of retrofit underperformance. It enables landlords to align retrofit measures with what will work in practice.

Such insights are maximised when marked to an insurer’s underwriting criteria. Project performance and financial outputs can be guaranteed – for example, forecasted energy savings and solar panel generation. Not only does this backstop underperformance but it protects residents from bill hikes due to faulty equipment.

Guaranteeing retrofits’ predicted energy outputs reassures private investors as well as landlords. Should a technology defect or a shortfall in bill reduction occur, they know they will be compensated. Reactive maintenance is covered in performance guarantees – meaning repair and replacement costs are externalised for social housing providers.

Balancing the books

Insurance policies not only function as a safety net for funders but transform retrofits into financial assets. In other words, they translate building engineering into a concept investors can get behind. The result? Access to institutional funding at a higher loan-to-cost for providers, with off-balance capacity.

While third-party funding enables project execution, it ultimately needs to be repaid. Using a ‘pay-as-you-save’ model, housing associations use a percentage of the realised (and guaranteed) energy bill savings to service this third-party capex. Between 10-50% of the savings stay with residents from day one. This increases to 100% once repayment ends – tackling fuel poverty at scale.

Blending private and public finance extends social housing providers’ existing budgets and makes deep retrofits possible. More predictable cash flows are established, with money freed up for investment in new builds.

An ecosystem approach in practice

As described above, a retrofit ecosystem connects the worlds of data analytics, engineering, insurance, and finance. It allows stakeholders to get on the same page, working towards the same pre-defined goals, in possession of the adequate funds. Such collaboration offers a streamlined approach to financially, socially, and environmentally sustainable retrofits.

If the social housing sector is to alleviate fuel poverty and the climate crisis at scale, stakeholders need to be speaking the same language. Only then will retrofitting Britain’s 5 million social homes go from an uncertain aspiration to a funded reality.

For more information on anything raised in this blog, please email contact@tallarna.com.

Author

Tim Meanock, CEO, Tallarna

Tim is the Chief Executive Officer at Tallarna. He co-founded the company in 2017 with a focus on addressing the funding gap in building decarbonisation. His deep knowledge of the financial sector has been instrumental in securing the company’s partnerships with ESG funders. Tim was previously a senior executive in a high growth technology company in the analytics space, and prior to that spent nine years in mid-market private equity with a focus on the real estate sector. He has been a director on nine different company boards, including Massive Interactive and David Lloyd Leisure.